You may be interested in learning about sources of funding for accelerators if you are aspiring to join the industry. Accelerators are programs that provide startups with mentorship, resources, and funding to help them grow and succeed. Funding for accelerators can come from a variety of sources, including venture capitalists, angel investors, and corporate partners.

One of the main benefits of participating in an accelerator program is the access to funding. Many accelerators provide seed funding to startups in exchange for equity. This can be a great way for startups to get the capital they need to grow their business and attract additional investors. In addition to funding, accelerators also offer mentorship and resources to help startups refine their business model, develop their product, and build their team.

1. Types of Funding for Accelerators

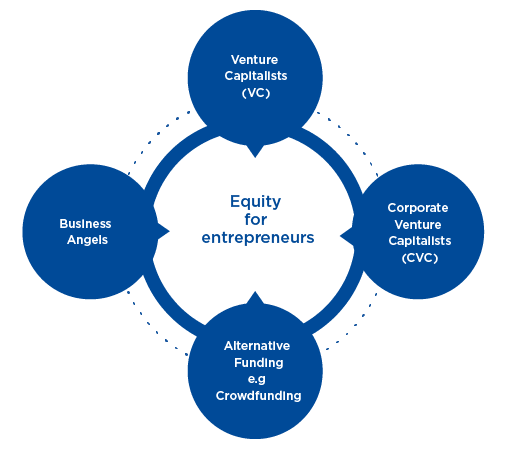

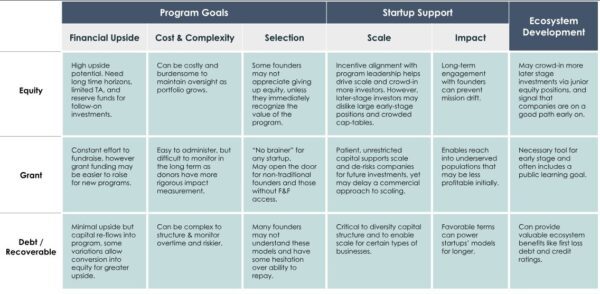

Accelerators, as already mentioned, are organizations that provide mentorship, resources, and funding to startups in exchange for equity or other forms of compensation. When it comes to sources of funding for accelerators, there are several types your organization can tap into. Here are some of the most common types of funding for accelerators:

Equity-Based Funding

Equity-based funding is the most common type of funding offered by accelerators. In this model, the accelerator provides funding to the startup in exchange for an equity stake in the company. The accelerator may also provide mentorship, resources, and other support to help the startup grow. The amount of funding and the equity stake will vary depending on the accelerator and the startup. Regardless, it is a significant source of funding for accelerators based on the return on investment.

Grant Funding

Grant funding is another type of funding that accelerators can offer. In this model, the accelerator provides funding to the startup in the form of a grant. Unlike equity-based funding, the accelerator does not receive an equity stake in the company. Grant funding is often used for startups that are working on social or environmental issues or to improve the local economy.

Corporate Sponsorship

Corporate sponsors also present a significant source of funding for accelerators. In this model, the corporate sponsor provides funding to the accelerator, and the accelerator uses that funding to support startups in its program. Corporate sponsors may also provide mentorship, resources, and other support to the startups.

Crowdfunding

Crowdfunding is a relatively new type of funding that some accelerators are starting to offer. In this model, the accelerator helps the startup launch a crowdfunding campaign to raise funds from the public. The accelerator may provide mentorship, resources, and other support to help the startup run a successful crowdfunding campaign.

2. Evaluating Accelerator Performance

When considering funding for accelerators, it’s important to evaluate their performance to ensure that your investment is being put to good use. Here are some key metrics to consider:

Success Metrics

One way to evaluate an accelerator’s success is to look at the number of startups that have successfully graduated from the program. This can be measured by the number of companies that have gone on to receive additional funding, the number of companies that have been acquired, or the number of companies that have gone public.

Another important metric to consider is the success rate of the accelerator’s portfolio companies. This can be measured by looking at the percentage of companies that have achieved significant revenue growth or profitability.

Return on Investment

Of course, one of the most important metrics for any investor is the return on investment (ROI). This can be measured by looking at the total amount of funding raised by the accelerator’s portfolio companies, as well as the valuation of those companies.

It’s important to keep in mind that ROI is not the only measure of success and that some accelerators may prioritize other goals, such as social impact or community building.

Alumni Achievements

Finally, it’s important to consider the achievements of the accelerator’s alumni. This can include the number of jobs created by these companies, as well as their impact on their respective industries.

Some accelerators may also have specific success stories that they like to highlight, such as companies that have developed cutting-edge technologies or achieved significant social impact.

By evaluating these metrics and considering the achievements of an accelerator’s alumni, you can make a more informed decision about whether to invest in a particular program.

3. Role of Government in Accelerator Funding

Accelerators are essential for startups looking to grow their businesses, and funding is a crucial aspect of their success. Government support for accelerators can help to create an environment where startups can thrive. Here are some ways in which the government can support accelerator funding.

Policy Frameworks

The government can create a policy framework that supports the growth of accelerators. This can involve creating regulations that make it easier for accelerators to operate and attract investment. The government can also create policies that encourage the development of accelerators in areas that need economic growth.

Tax Incentives

Tax incentives are another way that the government can support accelerator funding. The government can provide tax breaks to investors who invest in accelerators or startups. This can encourage more investment in accelerators and provide startups with the funding they need to grow.

Direct Funding Programs

Direct funding programs are another way that the government can support accelerator funding. The government can provide funding directly to accelerators or startups. This can help to bridge the funding gap that many startups face and provide them with the resources they need to grow.

Hence, the government can play a significant role in supporting accelerator funding. By creating a policy framework, providing tax incentives, and offering direct funding programs, the government can help to create an environment where startups can thrive.

Private Sector Involvement

When it comes to funding for accelerators, the private sector also has a significant role to play. Private sector involvement can come in various forms, including corporate venture arms, industry partnerships, and mentorship programs.

Corporate Venture Arms

Many corporations have started their own venture arms to invest in startups that align with their business goals. These venture arms provide funding, mentorship, and strategic partnerships to startups in exchange for equity. For example, Google Ventures has invested in companies such as Uber and Nest, while Intel Capital has invested in companies such as Dropbox and MongoDB.

Industry Partnerships

Industry partnerships are another way for startups to receive funding and support from the private sector. These partnerships involve collaboration between startups and established companies in the same industry. Startups can benefit from the expertise, resources, and networks of these established companies, while the established companies can gain access to innovative technologies and ideas. For example, BMW has partnered with startups such as ChargePoint and Scoop Technologies to develop electric vehicle charging infrastructure and carpooling services.

Mentorship Programs

Mentorship programs are also a valuable form of private sector involvement in funding for accelerators. These programs involve experienced entrepreneurs, investors, and industry experts providing guidance and support to startups. Mentorship programs can help startups refine their business models, develop their products, and navigate the challenges of the startup ecosystem. For example, Techstars, one of the largest startup accelerators in the world, provides mentorship to startups in its programs.

4. Global Trends in Accelerator Funding

When it comes to funding for accelerators, there are several global trends that are worth noting. Understanding these trends can help you make informed decisions about where to invest your money. In this section, we will explore some of the most significant global trends in accelerator funding.

Regional Hotspots

One trend that has emerged in recent years is the rise of regional hotspots for accelerator funding. These hotspots are areas where there is a high concentration of accelerators and a strong ecosystem to support them. Some of the most prominent regional hotspots include Silicon Valley in the United States, London in the United Kingdom, and Tel Aviv in Israel.

Emerging Markets

Another trend that has emerged in recent years is the growth of accelerator funding in emerging markets. These markets are often characterized by high levels of innovation and a willingness to take risks. Some of the most promising emerging markets for accelerator funding include China, India, and Brazil.

International Collaboration

Finally, there is a growing trend towards international collaboration in accelerator funding. This trend is driven by the recognition that innovation is a global phenomenon and that no one country or region has a monopoly on good ideas. As a result, we are seeing more and more cross-border collaborations between accelerators in different countries.

Understanding global trends in accelerator funding is essential for anyone looking to invest in this space. By keeping an eye on regional hotspots, emerging markets, and international collaboration, you can make informed decisions about where to allocate your resources.

5. Challenges and Risks

Market Saturation

With the increasing popularity of accelerators, the market has become increasingly saturated with an abundance of programs available to entrepreneurs. This saturation has led to a decrease in the quality of applicants, as well as an increase in competition for funding. As a result, accelerators must be selective in their application process to ensure they are investing in the most promising startups.

Funding Cycles

Accelerators are often structured around a fixed period of time, typically ranging from three to six months. This structure can create challenges for startups that require additional time to develop their product or secure additional funding. Additionally, the funding cycle for accelerators can be unpredictable, leaving startups uncertain about their financial future.

Regulatory Hurdles

Accelerators must navigate a complex regulatory environment, which can create significant challenges for both the accelerator and the startups they support. This includes compliance with securities laws, tax laws, and other regulations that vary by region and country.

To overcome these challenges and mitigate risks, accelerators must carefully select their startups, provide ongoing support and mentorship, and maintain strong relationships with investors and regulatory bodies. By doing so, accelerators can continue to provide valuable resources and funding to startups, while also ensuring their own long-term success.

6. Future of Accelerator Funding

Innovative Financing Models

Innovative financing models are emerging to fund accelerators. One such model is revenue-based financing, where investors receive a percentage of the accelerator’s revenue until a certain return on investment is achieved. This model aligns the interests of investors and accelerators and can provide a more sustainable funding source compared to traditional equity financing.

Another model gaining popularity is crowdfunding, where a large number of individuals invest small amounts of money to fund the accelerator. Crowdfunding can democratize access to capital and provide a wider pool of investors for accelerators.

Sustainability and Impact Investing

Sustainability and impact investing are becoming more important in the funding landscape. Investors are looking for accelerators that not only provide financial returns but also have a positive impact on society and the environment. Accelerators that focus on sustainability and impact investing can attract a new breed of investors and differentiate themselves from other accelerators.

Technology Advancements

Advancements in technology are changing the way accelerators are funded. Blockchain technology, for example, can enable the creation of decentralized accelerators that are run by a community of investors and entrepreneurs. This can provide a more democratic and transparent funding model for accelerators.

Artificial intelligence and machine learning are also being used to analyze data and identify promising startups for funding. This can help accelerators make better investment decisions and improve their overall performance.

In conclusion, the future of accelerator funding is evolving with innovative financing models, a focus on sustainability and impact investing, and advancements in technology. As an accelerator, it is important to stay abreast of these changes and adapt to the new funding landscape.